Too long; didn’t read summary:

- The Problem: Most shopping centers suffer from the “Data Black Box.” You know how many cars enter the lot, and you know the final sales figures at the register. But you have zero visibility on the 90 minutes in between.

- The Diagnosis: Without first-party data on shopper movement, malls cannot optimize rent rolls, effectively negotiate with tenants, or compete with e-commerce targeting.

- The Solution: Implementing a “Digital Layer” (Mobile App) to bridge the gap between physical footfall and digital analytics.

- The Outcome: A projected increase in Asset Value via in-app advertising revenue, extended dwell times, cross-shopping, and owned audience data.

Part 1: The “Blind Spot” in Asset Management

The Financial Impact: When you cannot prove traffic flow to specific zones, you lose leverage in lease negotiations. You are pricing your real estate based on guesswork, not data.

E-commerce giants like Amazon know exactly what a customer looked at, how long they hovered over the “Buy” button, and what they bought next.

Physical retail has historically relied on door counters.

But door counters don’t tell you:

- Why the West Wing has 30% less traffic than the East Wing.

- Whether the shopper who went to Apple also visited the food court.

- The exact “Customer Acquisition Cost” (CAC) of getting a local resident to return to the mall.

“It feels like fighting a war with the lights off.”

Part 2: The Intervention (Turning Footsteps into Fingerprints)

Don’t deploy a mobile application strategy focused on “coupons,” but on shopper experience.

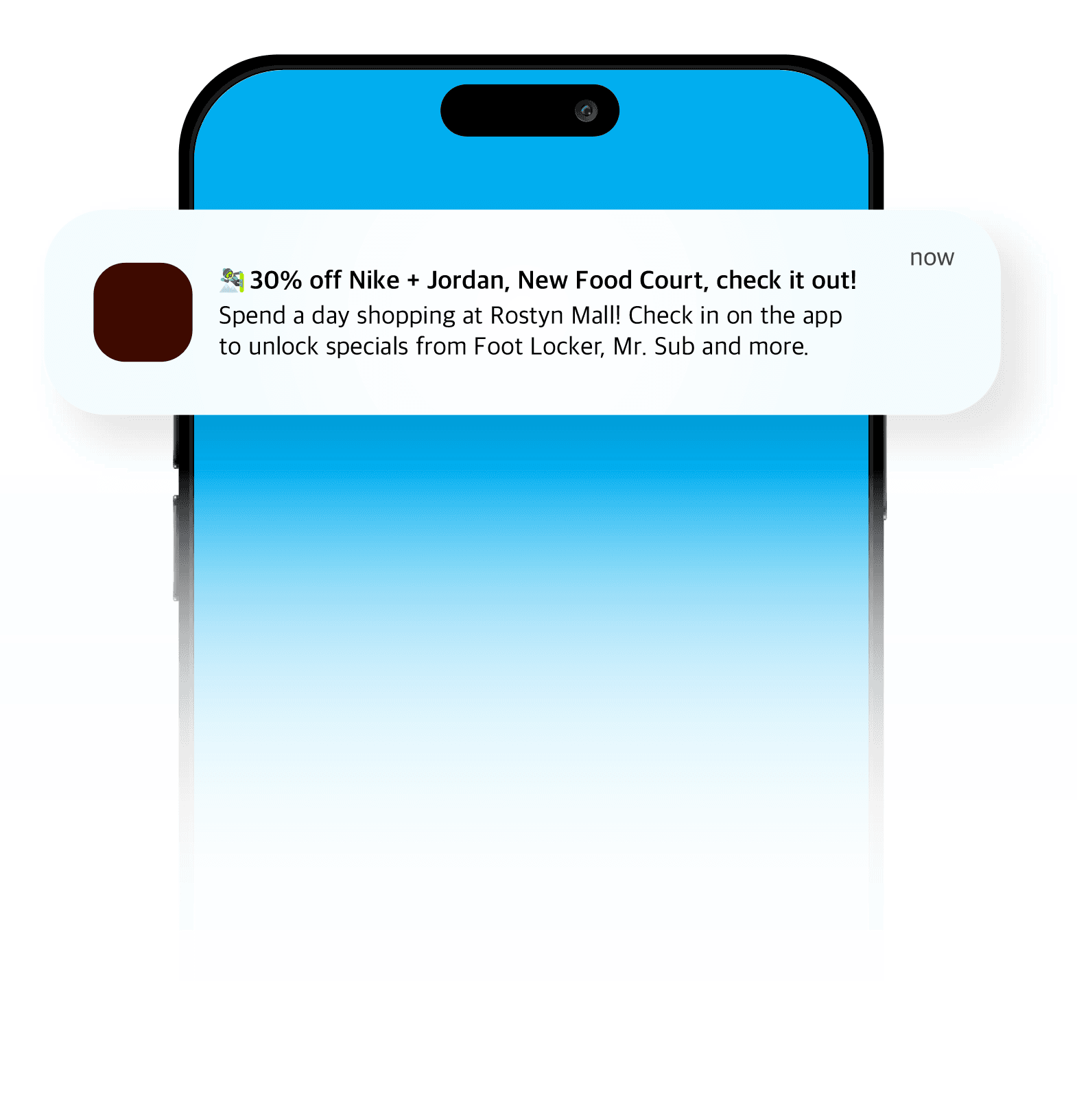

1. The Invisible Lure (Geofencing)

Don’t just build a map for your mall; you need some air traffic control!

The Tactic: When a high-value shopper enters the busy “Anchor A” zone, the app triggers a notification for a reward available only in the low-traffic “Inline Zone B.”

The Result: We effectively moved traffic from high-density areas to “dead zones,” instantly increasing the visibility (and value) of the struggle lease spaces.

2. Gamifying “Dwell Time”

Gamification is huge. Has your marketing team told you? Do you know about this and what it means?

The Tactic: Users earn points not just for spending, but for time at the mall.

The “Cap Rate” Multiplier

If an app for your mall generates an additional $100,000 in Net Operating Income (NOI), here is the impact on your balance sheet:

- Additional NOI: $100,000

- Market Cap Rate: 6.0%

- Asset Value Created: $1,666,666

Conclusion: The cost of the software is negligible compared to the $1.6M increase in property valuation on the balance sheet.

Part 3: The Financial Model (NOI & Valuation)

This is where the app moves from an “Expense” (OpEx) to an “Investment” (CapEx).

The Math of Dwell Time

Industry data suggests a direct correlation: For every 1% increase in dwell time, sales per square foot increase by roughly 1.3%.

Projected Asset Value Increase (Hypothetical Regional Mall)

| Metric | Without App | With App (Projected) | Impact |

|---|---|---|---|

| Avg. Dwell Time | 68 Minutes | 82 Minutes | +20% |

| Sales Per Sq. Ft. | $450 | $475 | Tenant Health |

| Ancillary Revenue | $0 | $60,000/yr | Direct NOI |

| Marketing Spend | High (billboards/radio) | Free (Push notifications) | OpEx Reduction |

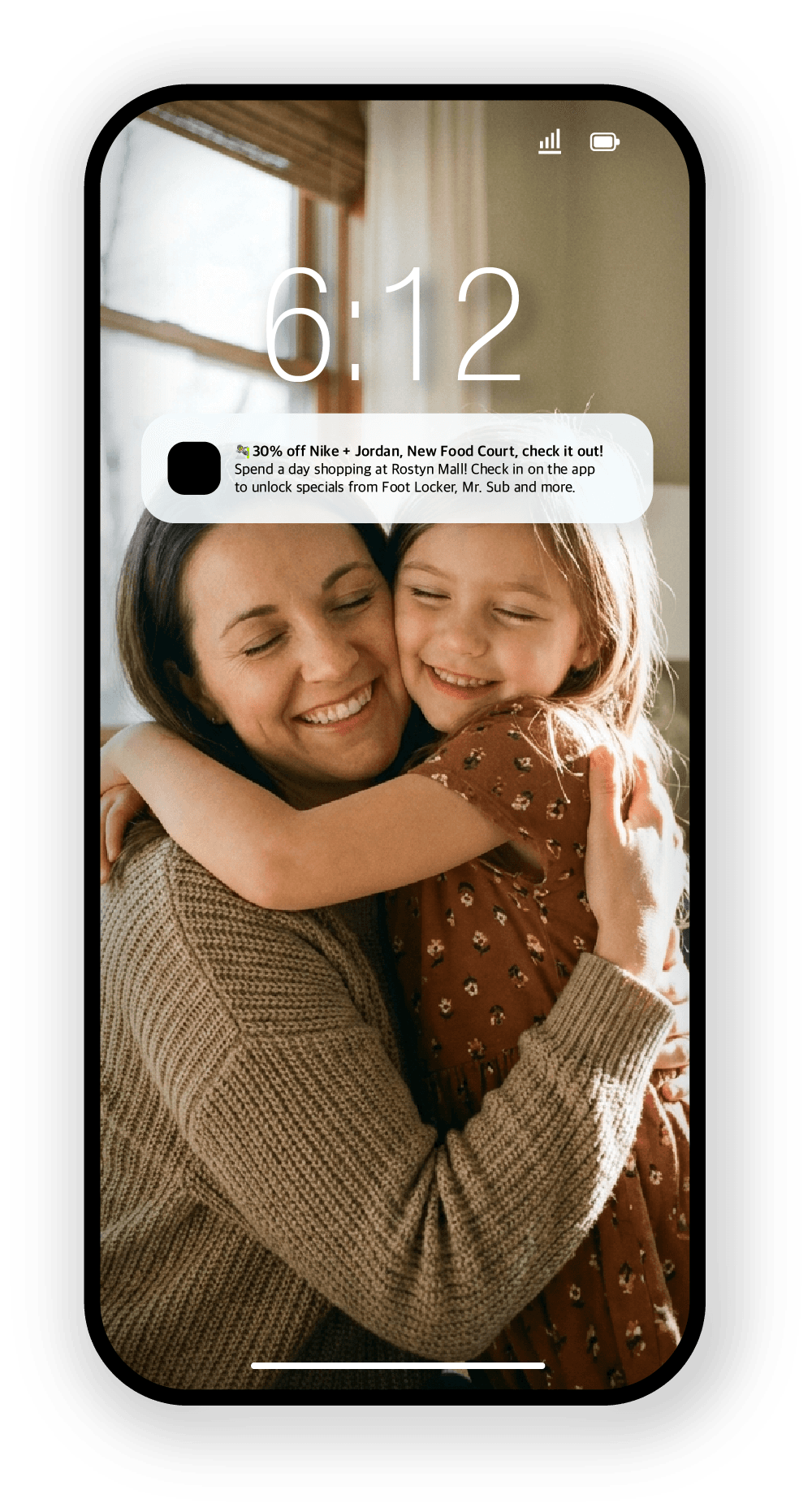

Part 4: Risk Mitigation (Owning the Audience)

In 2024, Facebook and Google changed their algorithms again. If you rely on social media ads to drive foot traffic, you are renting your audience.

But an app creates a First-Party Database.

- You own the phone numbers.

- You own the location data.

- You own the communication channel.

This “Digital Moat” makes the property significantly more attractive to future buyers or investors, as the customer base is a transferable asset.

Is this right for your property?

We are not a fit for every property. If your mall is fully leased with a waiting list, you might not need this data yet.